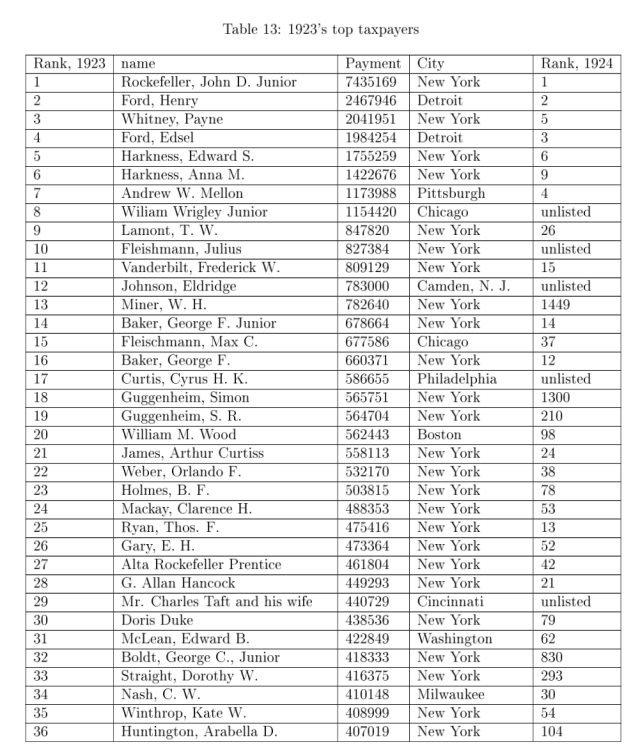

From page 71 of Daniel Marcin’s “The Revenue Act of 1924: Publicity, Tax Cuts, Response”

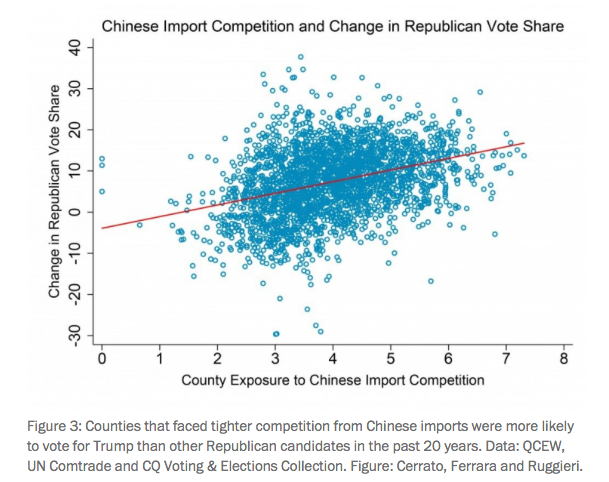

Here is an interesting article that my very talented research assistant Francesco Ruggieri co-authored with Cerrato and Ferrara on the impact of (Autor Dorn Hanson) trade shocks on county vote shares.

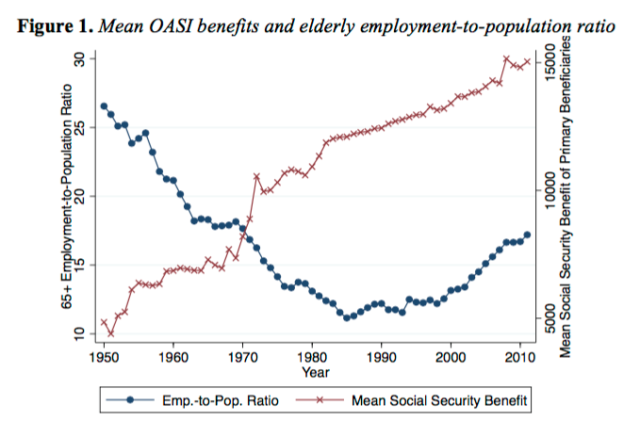

From Gelber, Isen, and Song:

We estimate the effect of pension income on earnings by examining the Social Security Notch, which cut lifetime discounted Old Age and Survivors Insurance (OASI) benefts by over $6,100 on average for individuals born in 1917 relative to those born in 1916. Using Social Security Administration microdata on the U.S. population by day of birth and a regression discontinuity design, we document that the Notch caused a large increase in elderly earnings. The point estimates show that a $1 increase in OASI benefits causes earnings in the elderly years to decrease by 46 to 61 cents due to an income effect, and the evidence is consistent with the hypothesis that only current (not future) benefits affect earnings. Under further assumptions we rule out more than a small substitution elasticity. Our results suggest that the increase in OASI benefits from 1950 to 1985 can account for at least half of the dramatic decrease in the elderly employment rate over this period.

Here is a new article from Chicago Booth Review that is worth a read

From Redding and Rossi-Hansberg:

The observed uneven distribution of economic activity across space is influenced by variation in exogenous geographical characteristics and endogenous interactions between agents in goods and factor markets. Until recently, the theoretical literature on economic geography had focused on styl- ized settings that could not easily be taken to the data. This paper reviews more recent research that has developed quantitative models of economic geography. These models are rich enough to speak to first-order features of the data, such as many heterogenous locations and gravity equation rela- tionships for trade and commuting. Yet at the same time these models are sufficiently tractable to undertake realistic counterfactuals exercises to study the effect of changes in amenities, productivity, and public policy interventions such as transport infrastructure investments. We provide an extensive taxonomy of the different building blocks of these quantitative spatial models and discuss their main properties and quantification.

From the NYTIMES:

Mossack Fonseca employees were named as the companies’ officers, avoiding whenever possible any link to the Ponsoldt family. The firm even asked a Hong Kong branch of Barclays, the international bank, to override its rules for proof of the so-called beneficial owners of the accounts.

“This is a very special client of ours,” a Mossack Fonseca lawyer wrote, conceding that the firm had intentionally created such a maze of companies so it “leaves us in the position to legally argue that our client is NOT the owner of the structure.” It was not clear if the bank complied.

In a recent paper on business ownership and taxation in the United States, we found complex ownership structures to be common place in the partnership sector:

Partnership ownership is not only concentrated, but also opaque. First, twenty percent of partnership income is earned by partners that we have not been able to classify in ad- ministrative data. Second, following money through partnership structures—between the partnership generating the income and the ultimate owners taxed on that income—proves challenging as well. We develop an algorithm that recursively traces income through partnership structures to ultimate non-partnership owners and attempts to assign that income back to an originating partnership. This recursive algorithm reaches a fixed point before all partnership income has been successfully assigned: fifteen percent of income is in circular structures and cannot be uniquely linked to an originating partnership. Together, the union of income flowing (1) to unclassifiable partners and (2) through circular partnerships amounts to $200 billion or thirty percent of income earned in the partnership sector overall.

From David Card, Ana Rute Cardoso, Joerg Heining, and Patrick Kline:

We review the literature on firm-level drivers of labor market inequality. There is strong evidence from a variety of fields that standard measures of productivity – like output per worker or total factor productivity – vary substantially across firms, even within narrowly-defined industries. Several recent studies note that rising trends in the dispersion of productivity across firms mirror the trends in the wage inequality across workers. Two distinct literatures have searched for a more direct link between these two phenomena. The first examines how wages are affected by differences in employer productivity. Studies that focus on firm-specific productivity shocks and control for the non-random sorting of workers to more and less productive firms typically find that a 10% increase in value-added per worker leads to somewhere between a 0.5% and 1.5% increase in wages. A second literature focuses on firm-specific wage premiums, using the wage outcomes of job changers. This literature also concludes that firm pay setting is important for wage inequality, with many studies finding that firm wage effects contribute approximately 20% of the overall variance of wages. To interpret these findings, we develop a model where workplace environments are viewed as imperfect substitutes by workers, and firms set wages with some degree of market power. We show that simple versions of this model can readily match the stylized empirical findings in the literature regarding rent-sharing elasticities and the structure of firm-specific pay premiums.